Hey there friend! Are you a Wyoming resident looking for dental insurance? You’ve come to the right place! In this article, we’ll be discussing all you need to know about dental insurance in Wyoming. From the types of plans available to cost-saving tips, we’ve got you covered. So, grab a cup of coffee and let’s dive in!

Everything You Need to Know About Wyoming Dental Insurance

When it comes to maintaining good oral health, dental insurance plays a significant role. Dental insurance can help manage costs and provide coverage for necessary procedures and treatments. In this article, we’ll take a closer look at dental insurance in Wyoming, how it works, and what you need to know.

Understanding the Basics of Wyoming Dental Insurance

Dental insurance is a type of health insurance that covers dental treatments and procedures. It is designed to help you manage your dental costs and provide financial protection against unexpected dental expenses. However, not all dental insurance plans are created equal.

Wyoming has a wide range of dental insurance plans to choose from, including the state-run Medicaid program. Medicaid is a federal and state-funded health insurance program designed to help low-income individuals and families who cannot afford healthcare coverage.

Private dental insurance plans are also available in Wyoming, including both individual and group plans. Employee-sponsored group dental insurance plans are more affordable and offer more benefits than individual plans. However, individual plans are still a good option for those who are not covered by an employer or want more coverage.

What Does Wyoming Dental Insurance Cover?

The benefits of Wyoming dental insurance vary depending on the plan you choose. Most dental insurance plans cover basic preventive care, such as routine cleanings and exams, as well as minor and major restorative treatments, including fillings, crowns, bridges, and root canals.

Orthodontic treatment may also be covered under some dental insurance plans, but typically requires an additional premium or a higher copay. Cosmetic dental procedures, such as teeth whitening and veneers, are typically not covered by dental insurance.

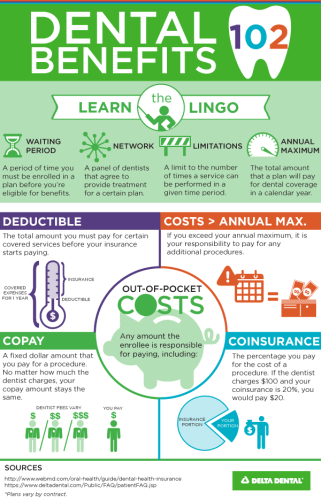

It’s important to note that most dental insurance plans have an annual maximum benefit limit, which is the maximum amount the insurance plan will pay for dental care over a year. Once you exceed the annual maximum, you will be responsible for paying any additional costs out of pocket.

How Does Wyoming Dental Insurance Work?

Dental insurance in Wyoming works similarly to traditional health insurance. You pay a monthly premium to your insurance provider, and in exchange, your provider covers a portion of your dental care costs.

When you visit the dentist, your insurance provider will cover a percentage of the cost of your treatment or procedure, and you will be responsible for paying the remaining balance. The percentage that your insurance provider covers varies depending on the plan you choose.

Some dental insurance plans require you to choose a primary care provider or dentist from a network of approved providers. If you visit a dentist outside of the network, you may have to pay more out of pocket.

Most dental insurance plans also require you to pay a copay or deductible for certain services. A copay is a fixed fee that you pay at the time of service, while a deductible is the amount you have to pay out of pocket before your insurance coverage kicks in.

Choosing the Right Wyoming Dental Insurance Plan

Choosing the right dental insurance plan can be overwhelming, but it’s important to do your research and choose a plan that meets your needs and budget. Here are a few factors to consider when choosing a dental insurance plan in Wyoming:

1. Coverage: Make sure the plan covers the services and treatments you need.

2. Cost: Consider the monthly premium, copays, and deductibles, and choose a plan that fits your budget.

3. Network: If you have a preferred dentist, make sure they are in the plan’s network.

4. Reputation: Look for reviews and ratings for the insurance provider to ensure they are reputable and reliable.

Conclusion

Dental insurance is essential for maintaining good oral health and protecting yourself from unexpected dental costs. Wyoming offers a variety of dental insurance plans to choose from, including private plans and the state-run Medicaid program. When choosing a plan, consider the coverage, cost, network, and reputation of the insurance provider. With the right dental insurance plan, you can ensure that you and your family receive the care you need to maintain healthy teeth and gums.