Hey there! Are you thinking about purchasing a property in Florida? Then, you might want to consider getting title insurance. However, you may be wondering about the cost of title insurance in Florida. In this blog post, we will discuss everything you need to know about title insurance cost in Florida. So, let’s dive in!

Title Insurance Cost Florida: Everything You Need to Know

If you’re buying a property in Florida, you need to be aware of title insurance. This type of insurance protects you from any potential ownership disputes over the property you’re buying. In this article, we’ll explore everything you need to know about title insurance cost in Florida.

What is Title Insurance?

Title insurance is a type of insurance that protects a homebuyer against any issues that may arise over the property’s ownership. The policy covers the homebuyer against any legal risks that could arise from claims to the property’s title. This could include ownership disputes, forgery, or fraud issues. The policy will also provide financial protection against any legal costs or damages that may arise in such a situation.

Title insurance is different from other types of insurance policies. While most insurance policies protect against future risks, title insurance provides coverage for past events that could impact a property’s title. When you purchase title insurance, a title agent will conduct a thorough search of public records to uncover any potential issues that could affect the property’s title. If any issues are discovered, the title agent will work to resolve them before issuing the policy.

Types of Title Insurance in Florida

In Florida, there are two types of title insurance: owner’s insurance and lender’s insurance.

Owner’s title insurance protects the homebuyer’s interest in the property, and it is often purchased at the same time as the property. It covers any legal issues related to the title, including ownership disputes, liens, or other problems that could affect the owner’s right to the property. The cost of owner’s title insurance is typically based on the property’s purchase price.

Lender’s title insurance, on the other hand, protects the lender’s interest in the property. It ensures that the lender has a valid and enforceable lien on the property in the event of a borrower default. The cost of lender’s title insurance is typically based on the loan amount.

Title Insurance Cost in Florida

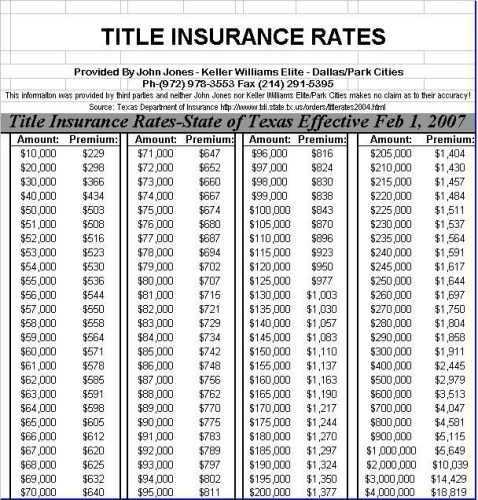

Title insurance cost in Florida varies depending on the property’s purchase price and the type of policy you select. Owner’s title insurance is typically more expensive than lender’s title insurance. The cost of title insurance is regulated by the Florida Department of Financial Services, and title insurance companies must file their rates with the state.

On average, title insurance in Florida costs between $500 and $2,000. However, the rate can vary depending on the price of the property. For example, if you’re purchasing a $500,000 property, you can expect to pay around $1,500 for owner’s title insurance. If you’re obtaining a $200,000 loan, the cost of lender’s title insurance may run around $500.

Factors that Affect Title Insurance Cost

Several factors impact title insurance cost in Florida. These include:

Property value: The cost of title insurance is typically a percentage of the property’s purchase price. The higher the property value, the more expensive the insurance policy.

Location: Some areas of Florida have higher title insurance rates due to their increased legal risk. In high-risk areas, the cost of title insurance may be higher to account for the extra risk.

Policy type: As previously mentioned, owner’s title insurance is typically more expensive than lender’s title insurance. The type of policy you choose will impact the cost of your title insurance policy.

Title Search Process: The cost of title insurance may also be affected by the title search process. If there are any issues that arise during the title search process that need to be resolved, this can increase the cost of title insurance.

Discounts on Title Insurance

Some insurance companies may offer discounts on title insurance policies. For example, if you’re purchasing a new home, some insurers may give you a discount if the property was built within the last ten years.

Some companies may also offer discounts if you obtain both lender’s and owner’s title insurance at the same time. Be sure to speak with a title agent to find out if you qualify for any discounts.

Conclusion

Title insurance is an essential part of any property purchase in Florida. It provides homebuyers with protection against any legal issues that could arise over the property’s ownership. The cost of title insurance in Florida varies depending on the property’s purchase price and the type of policy you select. Lender’s title insurance is typically less expensive than owner’s title insurance. However, the cost of title insurance can be affected by several factors, including the location of the property, the title search process, and the type of policy you select. Be sure to work with a reputable title agent to ensure you’re getting the best coverage for your needs.