Hey there! Are you tired of paying for everything upfront and draining your bank account? Well, let me introduce you to Afterpay – one of the most popular “buy now, pay later” services in the market. In this article, we’ll dive into how to download the Afterpay app and explore its benefits. So, grab your phone and let’s get started!

Afterpay: The Revolutionary Payment Method

Introduction

If you are an online shopper, you might have come across Afterpay as an option at the checkout page. Afterpay is a new payment model that has been making waves in the e-commerce industry. It has become increasingly popular among customers due to its convenience and flexibility.

In this article, we will discuss everything you need to know about Afterpay, including what it is, how it works, and its benefits and drawbacks.

What is Afterpay?

Afterpay is a payment method that allows customers to buy goods and services in installments, without having to pay any interest. It is similar to layaway plans but offers more flexibility as customers can receive the products immediately and pay later.

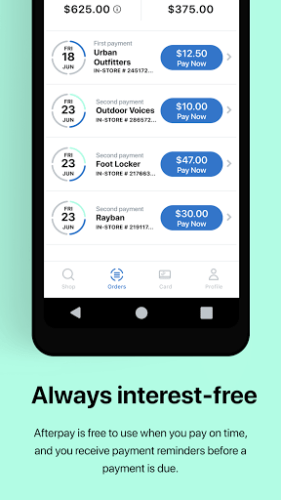

Afterpay works by splitting the total cost of the purchase into four equal installments. The customer pays the first installment at the time of purchase, and the remaining three payments are made every two weeks.

How Does Afterpay Work?

To use Afterpay, customers must first sign up for an account either on the Afterpay website or through the retailer’s website. The signup process is quick and straightforward as customers only have to provide their name, email address, and payment details. After the account is set up, customers can use it to make purchases from participating retailers.

Once the customer has added items to the cart and is ready to checkout, they will choose Afterpay as the payment method. They will then be directed to the Afterpay website to complete the purchase.

At this point, the customer will pay the first installment of 25% of the total purchase price. Afterpay will pay the full price of the item to the retailer, and the customer will take possession of the item.

The remaining three payments will be automatically deducted from the customer’s bank account every two weeks. Customers can log in to their Afterpay account to view payment schedules and manage their payments.

Benefits of Using Afterpay

Afterpay offers numerous benefits to customers, including:

1. No Interest

One of the main advantages of Afterpay is that customers do not have to pay any interest on their purchases. As long as they make their payments on time, they will not incur any additional fees. This makes Afterpay a more affordable option than credit cards and other payment methods that charge interest.

2. Increased Affordability

Afterpay makes it easier for customers to afford large purchases by splitting the payments into smaller installments. This means that customers can buy expensive items without having to pay the full amount upfront.

3. Instant Gratification

Afterpay allows customers to receive the items immediately and pay for them later. This means that customers do not have to wait until they have saved up enough money to make a purchase or use layaway plans.

4. Enhanced Budgeting

Afterpay can help customers budget their expenses as they know exactly how much they need to pay every two weeks. This helps them avoid overspending and ensures that they have enough money to cover other expenses.

Drawbacks of Using Afterpay

While Afterpay offers several benefits, it also has some drawbacks that customers should be aware of, including:

1. Late Fees

If a customer misses a payment, they will incur a late fee of $10. If they still have not made the payment after seven days, they will be charged an additional $7. Afterpay does send reminders before payments are due, but it is the customer’s responsibility to ensure that they have enough funds in their account and make the payment on time.

2. Limited Availability

Not all retailers offer Afterpay as a payment option. This means that customers may not be able to use Afterpay for all their purchases. However, the number of retailers accepting Afterpay is continually increasing.

3. Debt Accumulation

While Afterpay does not charge interest, customers may still accumulate debt if they do not manage their payments correctly. It is essential to budget and ensure that there is enough money in the account every two weeks to cover the payments.

Conclusion

Afterpay is a new payment model that is revolutionizing the e-commerce industry. It offers numerous benefits to customers, including increased affordability, instant gratification, and enhanced budgeting. However, it also has some drawbacks, such as late fees and debt accumulation.

Overall, Afterpay can be a great payment option for customers who want to buy expensive items without having to pay the full amount upfront. It is essential to manage payments correctly to avoid any late fees or debt accumulation.