Hey there! If you’re a motorcycle rider looking to stay safe on the road, you may have heard about SR22 motorcycle insurance. This special type of insurance is required in some states, and it’s important to understand what it is and why you might need it. So, let’s dive in and learn more about SR22 motorcycle insurance!

Title: Understanding SR22 Motorcycle Insurance: What You Need to Know

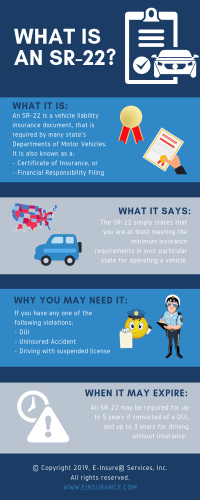

If you’re a motorcycle owner, you have likely heard of SR22 insurance before. An SR22 is a form filed with your state’s Department of Motor Vehicles (DMV) that provides proof of financial responsibility. It’s often required for drivers who have been convicted of certain driving offenses, such as DUI or driving without insurance.

But what exactly is SR22 insurance and how does it apply to motorcycles? In this article, we’ll provide a comprehensive guide to understanding SR22 motorcycle insurance.

1. What is SR22 Motorcycle Insurance?

SR22 insurance is a type of insurance that is specifically designed for high-risk drivers. It’s important to note that SR22 itself isn’t a type of insurance, but rather a certificate that proves you have insurance coverage.

SR22 motorcycle insurance generally refers to liability insurance coverage that meets your state’s guidelines for SR22 insurance. It’s mandatory for drivers who have been convicted of certain driving offenses and are required to file an SR22 form with the DMV.

2. Why do you need SR22 Motorcycle Insurance?

There are several reasons why you may need SR22 motorcycle insurance. The most common reasons include being convicted of a DUI or DWI, driving without insurance, or being involved in an accident while driving uninsured.

In general, if you are deemed a high-risk driver by your state’s DMV, you may be required to file an SR22 form to maintain your license and registration.

3. What does SR22 Motorcycle Insurance cover?

SR22 motorcycle insurance generally provides liability coverage, which means it covers damages you may cause to other drivers in an accident. Depending on the coverage you choose, it may also cover property damage and medical expenses.

It’s important to note that SR22 insurance does not provide coverage for damages to your own vehicle or injuries you may sustain in an accident. If you want to be fully covered, you’ll need to purchase additional insurance coverage.

4. How much does SR22 Motorcycle Insurance cost?

SR22 motorcycle insurance is typically more expensive than traditional insurance coverage due to the fact that it’s designed for high-risk drivers. In addition, insurance providers often charge fees for filing the SR22 form.

The cost of SR22 motorcycle insurance depends on a variety of factors, including your driving record, the state you live in, the type of motorcycle you own, and the level of coverage you choose. On average, you can expect to pay anywhere from $300 to $800 per year for SR22 motorcycle insurance.

5. How long do you need SR22 Motorcycle Insurance?

The length of time you need to maintain SR22 motorcycle insurance varies depending on the state you live in and the reason for the SR22 requirement. In general, you’ll need to maintain SR22 insurance for a minimum of three years.

It’s important to note that if you fail to pay your insurance premiums or allow your policy to lapse, your insurance provider is required to notify the DMV. This can result in your license and registration being suspended or revoked.

Conclusion:

In conclusion, understanding SR22 motorcycle insurance is important if you’ve been convicted of certain driving offenses or are considered a high-risk driver. SR22 insurance provides proof of financial responsibility and is generally required to maintain your license and registration.

While SR22 motorcycle insurance can be expensive, it’s a necessary expense for many drivers. It’s important to shop around and compare quotes from multiple insurance providers to ensure you’re getting the best deal.

Remember, maintaining SR22 motorcycle insurance for the required amount of time is crucial for keeping your license and registration in good standing. Be sure to make your payments on time and keep your policy active to avoid any potential penalties or suspension of your driving privileges.