Hey there! Wondering what Talro insurance payment is all about? Well, let me tell you! Talro Insurance is a car insurance company that operates in several states in the US. They offer a variety of insurance plans, and payment options to make it easy for you to manage your policy. Today, we’re going to talk about how you can pay your Talro insurance bill and the different payment methods available to you. So, let’s get started, shall we?

Talro Insurance Payment: What You Need to Know

If you’re a Talro Insurance policyholder, understanding the payment process is essential to ensure you stay up to date and avoid any penalty fees. In this article, we’ll explain everything you need to know about making your Talro Insurance payment, including payment methods, due dates, and how to avoid late payments.

Payment Methods

Talro Insurance offers various payment methods to make it convenient for customers to pay their premiums. Here are the payment options available to you:

Online Payment

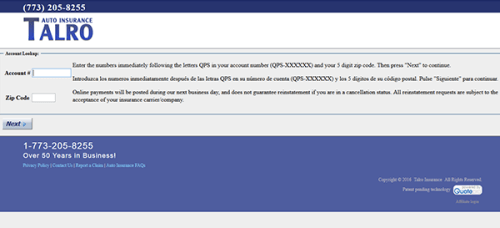

You can make your payment online by visiting the Talro Insurance website and logging into your account. From there, you can select the payment option and enter the necessary details to complete the transaction. Make sure you have your policy number handy to ensure smooth processing.

Mail-In Payment

If you prefer to make payments by mail, you can do so by sending your payment to the Talro Insurance office. Make sure to include your policy number on the check or money order and allow for adequate processing time to avoid late fees.

Phone Payment

You can also make your payment over the phone by calling the Talro Insurance customer service department. They will provide you with the necessary instructions for payment and help you complete the transaction over the phone.

Due Dates

It’s crucial to be aware of your payment due dates to avoid late fees or even a policy cancellation. Talro Insurance provides customers with various payment schedules, depending on their policy needs. Here are the most common due date schedules:

Monthly Payments

If you have a monthly payment schedule, your payment will be due on the same date every month. You can make your payment online, by mail or phone as described above.

Quarterly Payments

If you have a quarterly payment schedule, you’ll need to make your payment every three months. Your payment due date will depend on your policy’s effective date, and you can make your payment using the same options described above.

Annual Payments

If you prefer to pay your premium once a year, you can choose an annual payment schedule. Your payment will be due on the anniversary of your policy’s effective date. Make sure to mark your calendar and keep track of the due date to avoid potential penalty fees.

Late Payment

Late payment fees can be costly and detrimental to your policy. To avoid this, make sure to pay your premium on or before the due date. However, if you do miss a payment deadline, here’s what you need to know:

Grace Period

Talro Insurance provides a specified grace period for customers who miss their payment due date. This grace period can vary depending on your policy terms and the payment schedule you have chosen. Make sure to check your policy agreement to see how many days you have to make a payment without incurring fees.

Reinstatement Fee

If you do miss the grace period deadline, your policy may cancel, and you’ll need to pay a reinstatement fee to reinstate it. This fee can vary based on the policy and can be costly, so it’s essential to pay on time.

Policy Cancellation

Continuing to miss payment deadlines can result in policy cancellation. If your policy does cancel, it may be challenging to find a new policy if you have a lapse in coverage. It’s essential to be proactive to avoid cancellation and stay insured.

Tips to Avoid Late Payments

Nobody likes to pay extra fees or have their policy cancelled, so here are some tips to help you avoid late payment:

Set Reminders

You can use your phone, a calendar, or even set up automatic reminders on your computer to remind you of your payment due date. This can be beneficial if you have a busy schedule and tend to forget things easily.

Enroll in Autopay

If you’re forgetful, consider enrolling in Talro Insurance’s autopay program. This program will automatically deduct your payment from your bank account or credit card, ensuring you never miss a payment deadline.

Make Early Payments

If you can, make your payment earlier than the due date. This will help ensure that you don’t accidentally forget or experience any processing delays.

Avoid Late Payments at All Costs

Remember that late payments can result in costly fees, policy cancellation, and even difficulty finding new coverage. Avoid late payments at all costs by setting reminders, enrolling in autopay, or making early payments.

In Conclusion

Staying on top of your Talro Insurance payments is essential to avoid late fees and potential policy cancellation. Use the payment options available to you and stay aware of your due dates to ensure a smooth payment process. Remember to avoid late payments, set reminders, and enroll in autopay to stay on top of your payments and keep your policy active.